Plus, the beneficiary doesn’t have to be just your child, says Koski Cummings. There are no limits as to how many 529 plans you can open. For instance, your child’s internet while they’re at school and computer can be for qualified expenses.

VIRGINIA529 COLLEGE SAVINGS PLANNER FULL

However, you will need to pay income taxes.ĭue to the SECURE Act in 2019, funds from a 529 account can be used to pay up to $10,000 of a beneficiary’s student loan debt, or the student loan debt of their sibling.Īnd if your child receives a scholarship, you are able to withdraw funds from your account in the amount of the scholarship without incurring a penalty or fee.īefore you decide to withdraw funds, it’s important to go through the full list of qualified expenses to make sure you don’t miss anything, says Koski. The IRS lets you do this once every 12 months without getting hit with the 10% penalty. You can roll over funds as long as it’s a qualified family member. For one, you can roll over the money into an account for a different beneficiary. The good news is that there are quite a few ways to work around it, adds Koski.

VIRGINIA529 COLLEGE SAVINGS PLANNER PLUS

Should you not use all the funds in a 529 plan, you would be hit with a 10% withdrawal penalty, plus owe any income taxes on it. That’s because now you’re talking about potential taxes and penalties. If you don’t end up using the money in a 529 account or don’t end up using it for qualified educational expenses, it could potentially turn into a big headache, explains Johnson. A brokerage account lets you deposit and withdraw money but remember you must pay capital gains on the growth. Although you can’t pull your gains out without penalty until you’re 59 ½ but a Roth IRA allows college education as a qualifying reason to withdraw investments without penalty. Roth IRAs are retirement accounts that let you invest after tax-dollars. This gives you flexibility to use the funds for other things should your child decide not to go to college.Ī Roth IRA is another option.

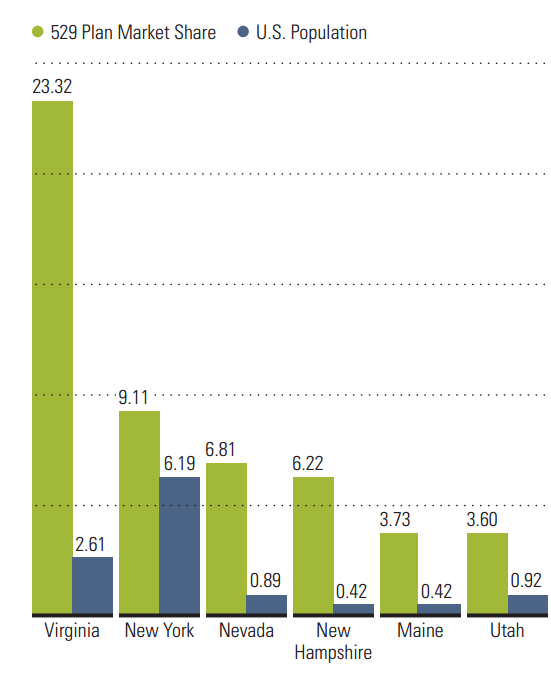

If you opt for a savings account, a high yield savings account could be a good option. These include savings accounts, Roth IRAs, and brokerage accounts to name a few. If you decide against a 529 plan, there are other ways to pay for college. If you make a withdrawal to cover expenses that are not education related, the IRS will count that as income and you’ll have to pay federal taxes on it. And in most states, there is a monthly requirement, sometimes in the amount of $10 or $50. For example, in Arkansas, an initial contribution of $500 is required. In some states, there are minimum contribution requirements to open a 529 plan. It’s usually on May 29th each year, which is deemed 529 Day. A nice little bonus is that some states will run a promotion, where they’ll give you $50 or $100 to open a 529 plan, explains Koski. Some state plans give you the choice to work with a fund manager, says Koski. “Once the account is set up, you get a menu of investments very similar to what you would get in your 401(k).” “It’s not any harder than your 401(k) at work,” says Koski. If you sign up for a 529 plan administered in another state, then you won’t be able to enjoy any state tax advantages.Īfter you’ve set up the account, you choose your investments. However, if you’re a resident of your state’s 529 plan, you might be able to take advantage of tax advantages at the state level. Most states have at least one 529 plan, and you don’t need to open a plan in your own state. “It comes out with no taxes, and no penalty,” says Johnson. 529s grow tax deferred, meaning the investments grow tax-free until the investor pulls them out, but only if they’re used for qualified expenses like college tuition, room and board. In relation to a 529, the target date fund will be more conservative as your child approaches college age.Īn attractive feature of 529 plans is that they come with some tax advantages. The younger you are the riskier your investments, and the older you are, the less risky they get. And as they get closer to attending college, it dials down that risk over time.”Ī target date fund helps take the guesswork out of retirement planning by adjusting your level of risk comparatively to your age. “It’s an investment option that adjusts based on the risk of the timeline. “Most of these 529 plans offer something called a target date fund that makes it easy on the customer,” says Jovan Johnson, a CPA and founder of Piece of Wealth Planning, a virtual planning firm. So you’ll want to do some comparison shopping and see which 529 plan is the best or your needs, situation, and benefits that appeal to you the most. You can open and invest in a 529 plan for any state, not just the state you live in.

0 kommentar(er)

0 kommentar(er)